Tariff Clouds Part, Is the Bull Market's Bugle Call Sounding Again?

Original Article Title: "Tariff Cloud Temporarily Lifted, Is the Bull Market Coming Back?"

Original Article Author: Azuma, Odaily Planet Daily

With new progress in the tariff negotiations between China and the United States, the crypto market sentiment is quickly heating up.

From last night to this morning, the market once again saw a significant surge. According to the OKX market data on Odaily, as of 9:30 AM, BTC broke through 115,000 USDT, reaching a high of 115,590 USDT, with a 24-hour gain of 3.02%; ETH approached 4,200 USDT, reaching a high of 4,194.84 USDT, with a 24-hour gain of 5.88%; SOL reclaimed the $200 mark, reaching a high of 205.09 USDT, with a 24-hour gain of 5.58%.

In addition to BTC, ETH, and SOL, the altcoin market finally saw a decent recovery, with some tokens showing impressive gains. For example, the consistently strong ZEC reached 368 USDT at one point, with a 24-hour gain of 30.03%; benefiting from the resurgence of AI concept popularity, VIRTUAL reached 1.5761 USDT at one point, with a 24-hour gain of 22.25%; popular protocols like PUMP, PENDLE, ENA also performed well, with 24-hour gains of 17.64%, 10.06%, 9.22%, respectively...

Driven by the overall market uptrend, the cryptocurrency's total market capitalization has rapidly rebounded. According to CoinGecko data, the current total market cap has returned to $3.984 trillion, with a 24-hour growth of 3.5%, just one step away from re-entering the $4 trillion mark. The cryptocurrency user's panic sentiment has also significantly eased, with today's Fear & Greed Index reaching 51, shifting from "Fear" to "Neutral."

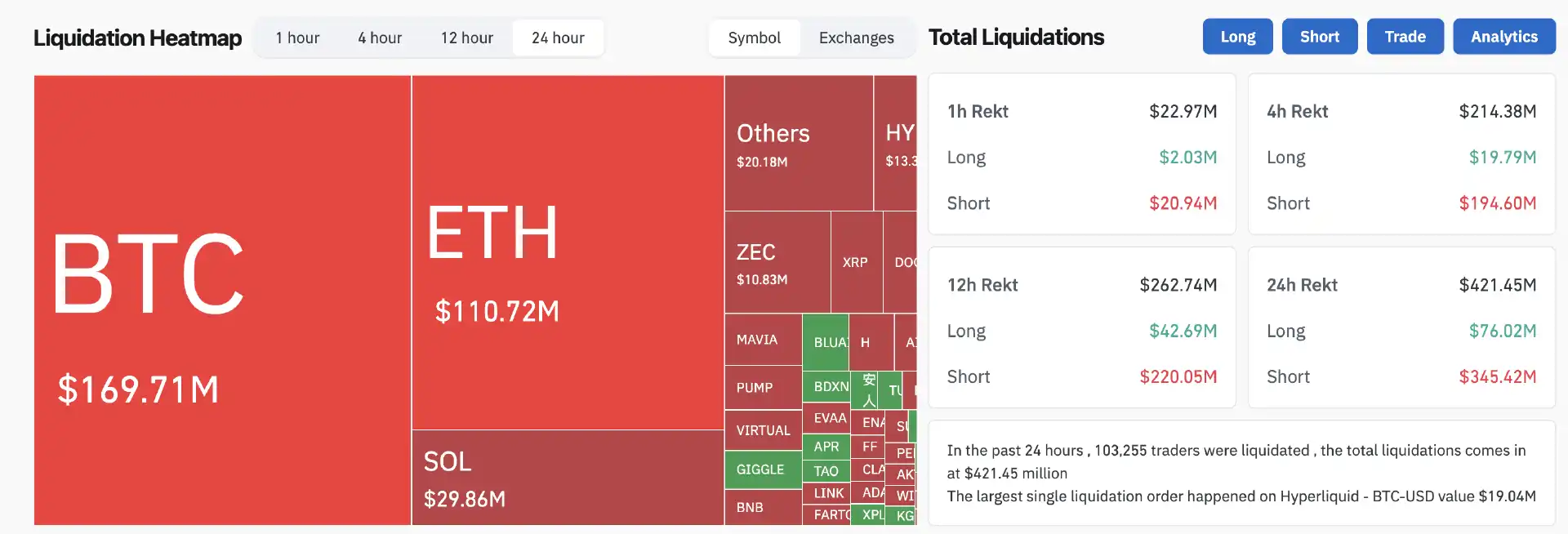

Regarding derivative trading, Coinglass data shows that over the past 24 hours, the entire network has liquidated $421 million, with the vast majority being short liquidations totaling $345 million. By asset, BTC had $169.7 million in liquidations, and ETH had $110.7 million.

Tariff Cloud Temporarily Lifted

From a news perspective, the most direct reason for the rapid market recovery is undoubtedly the new progress in the tariff negotiations between China and the United States.

From October 25th to 26th, Chinese Vice Premier and lead negotiator of the China-US economic and trade talks, He Lifeng, met with the US lead negotiators, US Treasury Secretary Yellen and Trade Representative Tai, in Kuala Lumpur for the China-US economic and trade negotiations.

Chinese Vice Minister of Commerce and Deputy China International Trade Representative Li Chenggang told reporters from domestic and foreign media after the talks that the two sides have reached a preliminary consensus on properly addressing several key economic and trade issues of mutual concern and will next go through their respective domestic approval procedures.

US Treasury Secretary Yellen also stated in an interview with US media after the conclusion of the talks that after the two-day meeting in Kuala Lumpur, the two sides reached a "very substantive framework agreement," laying the groundwork for a meeting between the leaders of the two countries. The US side has "ceased consideration" of imposing 100% tariffs on China. US Trade Representative Tai also stated at a press conference that the China-US trade negotiations have been fruitful, covering various topics, and the two sides are discussing the final details of a trade agreement proposal, which is almost ready for review by the leaders of the two countries.

Since earlier this month when Trump suddenly raised the issue of tariffs again, a shadow has been hanging over the cryptocurrency market and even the global financial markets. On October 11th, the market experienced a historic crash. As tensions gradually eased, the market naturally began to warm up. It seems to be Trump's classic "lift high, put down lightly" strategy, but fortunes have already undergone a major shift during these ups and downs.

Focus of the Week: Interest Rate Decision

The focus of the market this week is undoubtedly the Federal Reserve interest rate decision early Thursday morning—2:00 AM Beijing time on October 30th (Thursday), the Federal Reserve's FOMC will announce the interest rate decision and economic projections summary; then at 2:30 AM, Fed Chair Powell will hold a monetary policy press conference.

Last Friday, the US Bureau of Labor Statistics released September's overall and core inflation indicators, both of which were below expectations, paving the way for further Fed rate cuts. The US's non-seasonally adjusted CPI for September recorded an annual rate of 3%, a slight increase from the previous month's 2.9%, hitting a new high since January 2025 but slightly below the market's general expectation of 3.1%; the seasonally adjusted CPI for September recorded a 0.3% monthly rate, lower than the market's expectation and the previous value of 0.4%. The US's non-seasonally adjusted core CPI for September recorded an annual rate of 3%, lower than the market's expectation and the previous value of 3.1%; the seasonally adjusted core CPI for September recorded a 0.2% monthly rate, also lower than the market's expectation and the previous value of 0.3%.

After the CPI data was released, traders increased their bets on the Fed cutting interest rates twice more this year. CME's "Fed Watch" data shows that the probability of a 25 basis point rate cut by the Fed in October is currently at 97.3%, with only a 2.7% probability of keeping rates unchanged; the probability of a total 50 basis point rate cut by the Fed by December is at 95.5%.

Insider Whales' Move: Continued Bullish Outlook

Setting aside all traditional influencing factors with uncertainty, abstracting the market trend into a minimalist question, the most influential individual recently is undoubtedly the whale with a 100% win rate since the 10/11 plunge.

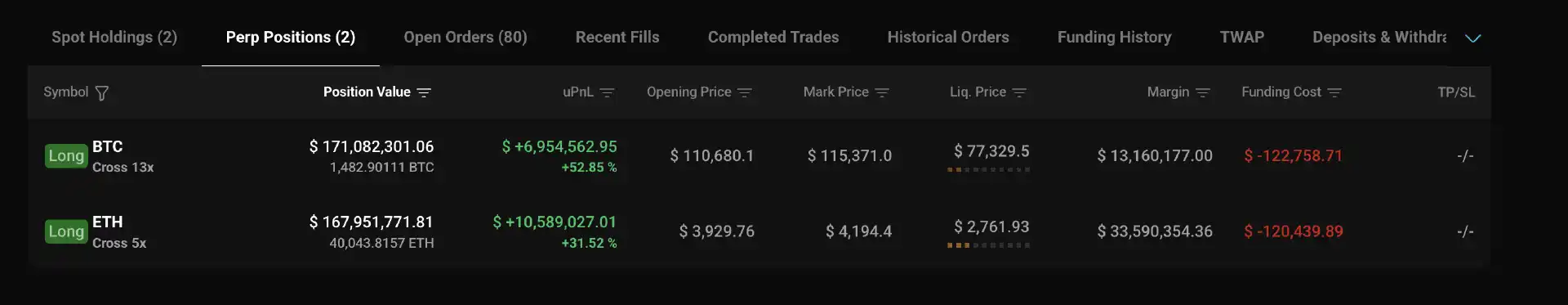

HyperBot data shows that the "10/11 100% Win Rate Whale" currently holds 13x BTC longs and 5x ETH longs with an unrealized gain of around $17.54 million. Moreover, they have not taken profits yet and even added 1,868 ETH longs three hours ago. Currently, the whale's total position is worth approximately $339 million, with BTC longs valued at around $171 million at an entry price of $110,680 and ETH longs valued at around $168 million at an entry price of $3,929.

Evidently, the whale is still bullish. Whether based on insider information or technical analysis, closely following the whale's short-term moves might be the optimal response to the current market trend.

You may also like

Crypto Price Prediction Today 18 February – XRP, Bitcoin, Ethereum

Key Takeaways XRP’s potential as a replacement for SWIFT is bolstered by regulatory approvals, potentially driving its price…

XRP Price Prediction: XRP is Outpacing Solana and Targeting Binance Coin Next – Should You Invest Now?

Key Takeaways XRP Ledger has moved into the sixth place by tokenized real-world asset value, surpassing Solana and…

New AI Predicts the Price of XRP, Dogecoin, and Solana By 2026

Key Takeaways ChatGPT anticipates significant price increases for XRP, Dogecoin, and Solana by the end of 2026. XRP…

Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Key Takeaways Arthur Hayes predicts a significant crypto rally fueled by a $572 billion liquidity injection from the…

Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know?

Key Takeaways Abu Dhabi has revealed a $1 billion stake in Bitcoin through major ETF investments, signaling strong…

Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes

Key Takeaways Arthur Hayes highlights a concerning divergence between Bitcoin and the Nasdaq, pointing to a potential dollar…

Lagarde’s Possible Early Exit Could Alter Digital Euro Plans and Stablecoin Oversight

Key Takeaways Christine Lagarde’s potential departure as ECB president may disrupt the digital euro timeline and stablecoin policies.…

HYLQ Strategy Invests in Hyperliquid Quantum Solutions Pioneer qLABS, Acquires 18,333,334 qONE Tokens

Key Takeaways HYLQ Strategy Corp has made a strategic investment in qLABS, purchasing over 18 million qONE tokens…

WLFI Crypto Surges Toward $0.12 as Whale Purchase Precedes Trump-Linked Forum

Key Takeaways Whale accumulation has spurred a rally in WLFI crypto prices, reaching towards $0.12 ahead of a…

Cathie Wood Reverses Path with $6.9 Million Purchase in Coinbase Stock – Is ARK Strategizing a Rebound?

Key Takeaways ARK Invest acquires 41,453 shares of Coinbase, showing renewed interest post recent divestment. This acquisition by…

Crypto Lobby Establishes Working Group to Advocate for Prediction Market Regulatory Clarity

Key Takeaways The Digital Chamber announced the Prediction Markets Working Group to promote federal oversight of prediction markets.…

Peter Thiel Discreetly Withdraws from Ethereum Treasury Venture ETHZilla – A Cautionary Note for the DAT Model?

Key Takeaways Peter Thiel and Founders Fund have completely exited their position in ETHZilla. Thiel’s withdrawal raises questions…

Coin Center Advocates Protecting Crypto Developer Liability

Key Takeaways Coin Center is actively lobbying the U.S. Senate to safeguard crypto developer liability protections. The ongoing…

$150B in US Tax Refunds Could Catalyze Fresh Crypto Inflows, Historical Trends Indicate

Key Takeaways The IRS anticipates distributing approximately $150 billion in tax refunds to U.S. consumers by the end…

Oracle Error Leads DeFi Lender Moonwell to $1.8 Million in Bad Debt

Key Takeaways A critical oracle pricing glitch caused Moonwell to incur nearly $1.8 million in bad debt. The…

Crypto Price Prediction Today 18 February – XRP, Solana, Dogecoin

Key Takeaways XRP targets a $5 move, driven by its role as an alternative to SWIFT for cross-border…

China’s DeepSeek AI Predicts the Price of XRP, PEPE, and Shiba Inu By the End of 2026

Key Takeaways DeepSeek AI suggests significant potential price increases for XRP, PEPE, and Shiba Inu by 2026. XRP…

XRP Battles Key Support Amid Grayscale Sentiment Surge

Key Takeaways XRP has experienced a 29% price drop recently, creating a tense atmosphere among traders eyeing key…

Crypto Price Prediction Today 18 February – XRP, Bitcoin, Ethereum

Key Takeaways XRP’s potential as a replacement for SWIFT is bolstered by regulatory approvals, potentially driving its price…

XRP Price Prediction: XRP is Outpacing Solana and Targeting Binance Coin Next – Should You Invest Now?

Key Takeaways XRP Ledger has moved into the sixth place by tokenized real-world asset value, surpassing Solana and…

New AI Predicts the Price of XRP, Dogecoin, and Solana By 2026

Key Takeaways ChatGPT anticipates significant price increases for XRP, Dogecoin, and Solana by the end of 2026. XRP…

Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Key Takeaways Arthur Hayes predicts a significant crypto rally fueled by a $572 billion liquidity injection from the…

Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know?

Key Takeaways Abu Dhabi has revealed a $1 billion stake in Bitcoin through major ETF investments, signaling strong…

Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes

Key Takeaways Arthur Hayes highlights a concerning divergence between Bitcoin and the Nasdaq, pointing to a potential dollar…