Why Has the Cryptocurrency Market Sentiment Suddenly Become So Bearish?

Original Article Title: Why Did Crypto Sentiment Get So Bearish?

Original Author: Jack Inabinet, Bankless

Translation: Peggy, BlockBeats

Editor's Note: Just four days after Bitcoin hit a new all-time high, the crypto market saw an unprecedented "10/10 Flash Crash." Not only did major coins plummet, but several altcoins went to zero, and even exchanges faced liquidation crises. Meanwhile, high-leverage yield funds like Stream Finance went bust in succession, revealing the fragile nature of the "trust me" bubble. The optimistic sentiment on social platforms quickly turned into panic, and market confidence took a heavy blow.

This article reviews the events leading up to this series of incidents and attempts to answer a key question: why did crypto market sentiment suddenly become so bearish? In the current environment of a bursting bubble and a crisis of trust, we may be at a turning point in a new cycle.

The following is the original text:

On Monday, October 6, 2025, Bitcoin hit a new all-time high, breaking through the $126,000 mark for the first time. Whether in the trenches of Crypto Twitter or between the lines of CNBC's news, hodlers were immersed in the ubiquitous "fog of hope."

Despite little change in fundamentals in the following month, just four days later on October 10, the crypto market faced a crisis—the "10/10 Flash Crash" is now seen as the largest liquidation event in crypto history.

In this catastrophic downturn, major coins plummeted by double digits, many altcoins went straight to zero, and several exchanges teetered on the brink of bankruptcy (almost all major perpetual contract platforms triggered automatic deleveraging due to inability to cover short profits).

While Trump's election as president was seen as a positive development for the crypto industry—from establishing a strategic Bitcoin reserve to appointing seemingly pro-crypto regulatory officials—the price of crypto assets continued to languish.

Apart from a brief rally shortly after Trump's election in November last year, the total crypto market cap (TOTAL) has remained relatively flat compared to the S&P 500 index for nearly a year. In fact, the ratio between the two since Trump's official inauguration on January 20 has shown a staggering negative growth.

As the market continues to digest the aftermath of the 10/10 liquidation event, more and more questions are beginning to surface.

Just this past Monday, Stream Finance announced bankruptcy. This was a $200 million "trust me" style crypto yield fund that relied on leverage to provide depositors with above-market returns. Its "external fund manager" lost approximately $93 million in assets through its operations.

While details have not been disclosed, Stream is likely the first publicly known "Delta Neutral" strategy fund to blow up due to the 10/10 auto-deleveraging mechanism. Despite its structure having long been questioned, this collapse still caught many lenders off guard—they sacrificed security for higher returns without a clear risk signal.

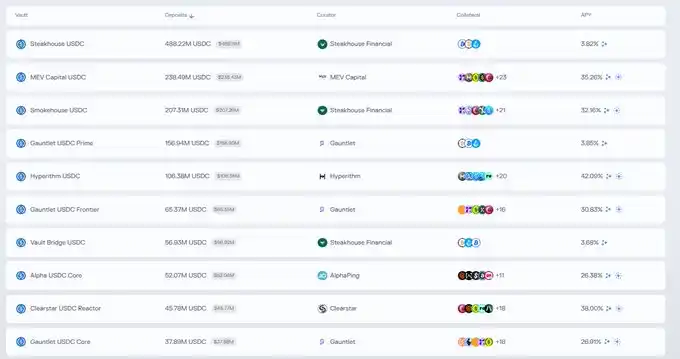

Following Stream's collapse, panic quickly spread throughout the entire DeFi ecosystem as investors began collectively exiting similar high-risk yield strategies.

While the domino effect of Stream has not yet fully spread, this event has exposed the risk of the increasingly popular "stablecoin mining" strategy in DeFi—using deposit receipts from existing high-risk strategies to leverage up for higher returns.

Stream's self-reported losses also revealed the significant losses Delta Neutral funds could face in the 10/10 auto-deleveraging event: short hedges were forcibly unwound by the system, while spot longs were instantly liquidated.

Although the news headlines have shifted, it is certain that the losses on October 10th were catastrophic.

Whether through public DeFi operations or secretive CeFi operations, there are billions of dollars in leverage present in crypto yield funds. The question of whether the market has enough liquidity to withstand a potential wave of liquidations remains unanswered.

It is currently unclear who is "skinny dipping," but it is certain that someone in the crypto casino is already without swim trunks. If the market experiences another downturn, especially after allegations of insolvency against centralized exchanges during the 10/10 liquidation period, the concern shifts from "if something will go wrong" to "can the entire industry handle it."

You may also like

Bitcoin's Big Brother Scythe, a Nasdaq Heist Chronicle

ARK Invest: Stablecoins are Constructing the Next-Generation Monetary System

President Trump Asserts Imminent Passing of Crypto Market Structure Bill

Key Takeaways Presidential Confirmation: President Trump states the major crypto market structure bill is on the verge of…

Germany Central Bank Head Advocates for European Crypto Stablecoins Under EU MiCA Framework

Key Takeaways Joachim Nagel, head of the Germany Bundesbank, is advocating for the adoption of euro-based crypto stablecoins…

Polygon Surpasses Ethereum in Daily Fees as Polymarket Bets Rocket

Key Takeaways Polygon has outpaced Ethereum in daily transaction fees, a historic shift driven by activity on Polymarket.…

Bitcoin Price Prediction: BTC Short Squeeze Alert – Is a Significant Rebound on the Horizon?

Key Takeaways Recent data indicates Bitcoin shorts have escalated to unprecedented levels reminiscent of a major market low…

Google’s Gemini AI Predicts the Price of XRP, Solana, and Bitcoin by the End of 2026

Key Takeaways XRP’s Potential: Google’s Gemini AI forecasts XRP could reach $10 by 2026, leveraging Ripple’s payment solutions…

Top Analyst Warns Bitcoin Price Could Plummet to $10,000 Amid Deepening Bear Market

Key Takeaways Bitcoin’s value could potentially drop to $10,000 as part of an imploding bubble, suggests a renowned…

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is poised for long-term growth with its recent strategic expansions in institutional-grade payments and tokenization.…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, after leaving Multicoin Capital, criticized Hyperliquid, a decentralized exchange, labeling it as a systemic…

XRP Price Prediction: A 50M Token Sell-Off Just Shook the Market — Is More Loss Imminent?

Key Takeaways Over 50 million XRP hit the market within a span of less than 12 hours, leading…

Strategy Plans to Equitize Convertible Debt Over 3–6 Years: What It Means for BTC

Key Takeaways Strategy, led by Michael Saylor, is equitizing $6 billion in convertible debt as a long-term strategy…

BlockFills Freezes Withdrawals as Bitcoin Declines, Heightening Counterparty Risk Concerns

Key Takeaways BlockFills, an institutional trading firm, has stopped client withdrawals amid rising market volatility and Bitcoin price…

Leading AI Claude Predicts the Price of XRP, Cardano, and Ethereum by the End of 2026

Key Takeaways Claude AI projects substantial growth for XRP, Cardano, and Ethereum by the end of 2026, with…

Crypto Price Forecast for 16 February – XRP, Ethereum, Cardano

Key Takeaways Technical trends and recent developments suggest potential growth for XRP, Ethereum, and Cardano. XRP is targeting…

Bitcoin Price Prediction: Alarming New Research Warns Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Protected?

Key Takeaways Recent market movements have sparked concerns over a potential bear market for Bitcoin, marked by significant…

XRP Price Forecast: Can XRP Truly Surpass Bitcoin and Ethereum? Analyst Argues the Contest Has Already Begun

Key Takeaways XRP has maintained significant support around the $1.40 level despite a 12% decline over the past…

Best Crypto to Purchase Now February 6 – XRP, Solana, Bitcoin

Key Takeaways XRP’s Strength: Ripple’s focus on challenging traditional systems like SWIFT is driving XRP towards a potential…

Bitcoin's Big Brother Scythe, a Nasdaq Heist Chronicle

ARK Invest: Stablecoins are Constructing the Next-Generation Monetary System

President Trump Asserts Imminent Passing of Crypto Market Structure Bill

Key Takeaways Presidential Confirmation: President Trump states the major crypto market structure bill is on the verge of…

Germany Central Bank Head Advocates for European Crypto Stablecoins Under EU MiCA Framework

Key Takeaways Joachim Nagel, head of the Germany Bundesbank, is advocating for the adoption of euro-based crypto stablecoins…

Polygon Surpasses Ethereum in Daily Fees as Polymarket Bets Rocket

Key Takeaways Polygon has outpaced Ethereum in daily transaction fees, a historic shift driven by activity on Polymarket.…

Bitcoin Price Prediction: BTC Short Squeeze Alert – Is a Significant Rebound on the Horizon?

Key Takeaways Recent data indicates Bitcoin shorts have escalated to unprecedented levels reminiscent of a major market low…