Solana In-Depth Review 2026: Is It Still the Fastest Blockchain or a Bubble Repeating?

Top-line verdict: Is Solana still the fastest chain — and does speed equal survivability?

Solana remains among the highest-throughput layer-1s with real-world bursts above 5k TPS and multi-month averages near 1k TPS, but throughput alone no longer buys trust. Repeated halts, software fixes, and economic shifts since 2021 mean Solana’s future hinges on security hardening, validator decentralization, and real revenue, not raw TPS.

I say this as someone who traded through 2025’s security storms: speed is a tool, not a credential. In 2025 Solana averaged >1,100 TPS on many days, proving it can move volume; but markets punished ambiguity around liveness and validator economics.

What “fastest” means in 2026: raw TPS vs real throughput and finality

“Fastest” has two measures: theoretical peak TPS and sustained, real-world throughput under load. Solana’s theoretical ceiling (tens of thousands TPS from lab tests) differs from sustained production throughput (~1k TPS average in 2025), and its sub-second block times deliver low-latency finality for many applications.

Fact: Solana advertises high theoretical TPS; independent dashboards show average production numbers closer to 1k TPS across 2025, with spikes and 100-block maxima far higher. That matters for exchanges and HFT-style liquidity providers who need sustained order-book depth, not just a marketing TPS number.

Outages and halts: what actually happened, and were vulnerabilities fixed?

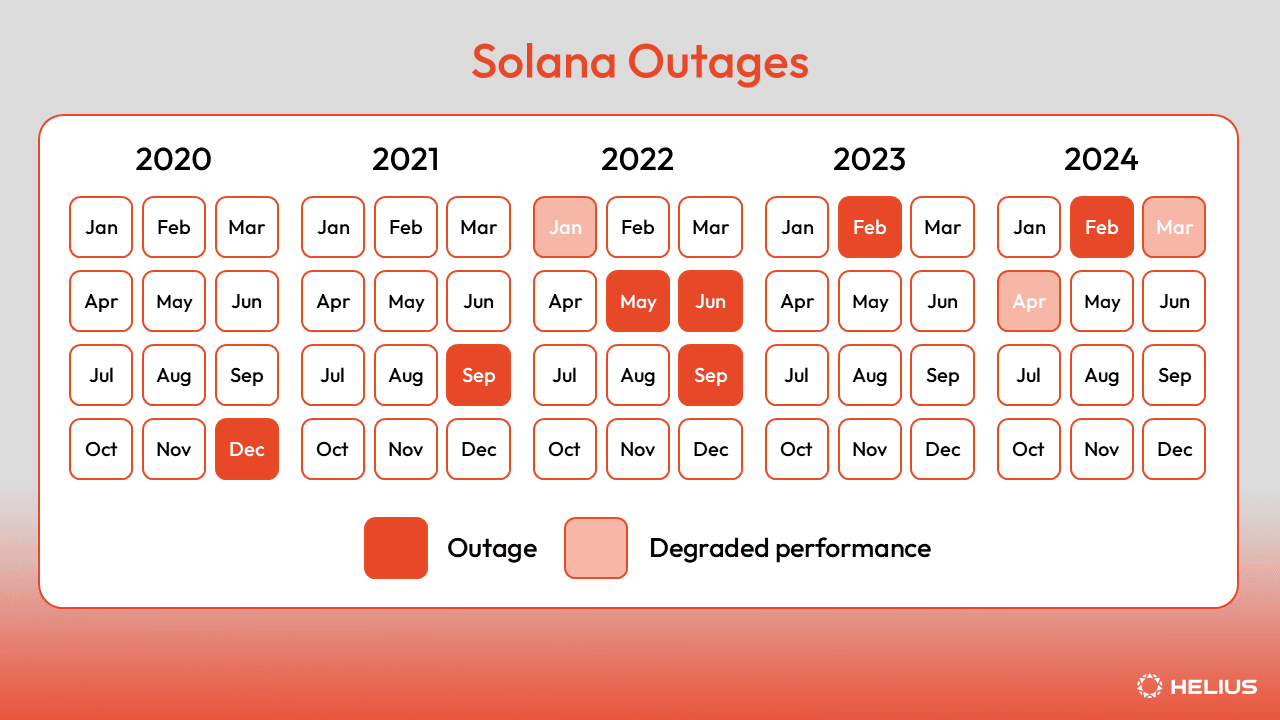

Solana’s history includes multiple high-profile halts caused by validator overloads, leader election edge-cases, and replay storms. The dev community has patched many root causes, introduced rate-limit and leader-rotation fixes, and updated restart tooling — but research shows a nontrivial halting attack remains theoretically possible without further decentralization.

Concrete data point: detailed incident timelines cataloged by Helius show recurrent halts and the fixes applied through early 2025. Solana Labs and validators implemented new restart protocols and monitoring after the 2023–2025 incidents, which materially reduced downtime frequency but did not eliminate all risk.

Academic note: a 2021 ACM-style analysis demonstrated how a malicious leader stake could, under certain conditions, halt the network — proof that protocol-level liveness must coexist with governance and economic design fixes. These theoretical attacks informed later engineering changes.

How the 2025 security crises reshaped Solana’s technical roadmap

The 2025 crises forced Solana’s engineering roadmap toward liveness hardening, validator economics rework, and production-grade telemetry. Teams prioritized guardrails — leader rotation tweaks, throttling for heavy RPC loads, and clearer restart playbooks to reduce mean time to recovery (MTTR).

I watched the community shift from optimistic throughput bragging to disciplined ops. The post-2024 focus was software instrumentation and node behavior rules that trade some peak throughput for predictable uptime — a deliberate trade that improves trust among institutional integrators.

Ecosystem health: DeFi, exchanges, and the aftermath of FTX/Serum

Solana’s DeFi ecosystem restructured after the FTX/Serum episode: community forks (like Open Book) and new AMMs regained market share, but centralized liquidity and market making shifted in profile. DeFi TVL and protocol composition changed: more concentrated liquidity in resilient protocols and more emphasis on audited programs.

Fact: Serum’s collapse in 2022 left a gap that community projects and AMMs filled; by 2025–2026, projects focused on governance decentralization and independent key custody, shifting liquidity to Open Book and Orca-style pools. That transition reduced single-point trust risk but didn’t erase counterparty or smart contract risk entirely.

Developer activity and protocol upgrades: who’s shipping and what matters

Active dev work on Solana in 2025–2026 emphasized scalability tooling, SPL token improvements, on-chain order-book primitives (Open Book), and tooling for MEV protection and RPC resilience. Solana’s Foundation and ecosystem firms published multiple SDK updates and benchmarking suites.

Key names to watch: Solana Foundation, Helius (infrastructure), OpenBook Labs, and ecosystem toolkits (Solana CLI upgrades and bench tooling like Solana Bench). Those groups drove production improvements that mattered to exchanges and market makers.

Tokenomics and network revenue: is SOL’s value supported by real fees?

Network revenue fell sharply from peak fee spikes, but Solana’s 2025 average fees and validator commission dynamics stabilized real revenue streams; overall protocol revenue dropped from hyper-spike months to steadier monthly figures near the mid-tens of millions, shifting the valuation narrative toward adoption and utility instead of pure fee speculation.

Data point: some industry trackers reported Solana network revenue declined dramatically from peak months in 2024–2025 to lower steady state figures by late 2025; sustainable token value requires consistent real use, not transient NFT or gaming blowups.

Security incidents beyond halts: bridges, exploits, and their fixes

Beyond halts, Solana suffered bridge and contract exploits (notably Wormhole and other cross-chain risks historically), prompting heavier auditing, insurance pushes, and guarded bridge designs. Many teams adopted multi-sig custody, time-locked governance, and continuous auditing to reduce exploit surface.

Example: Wormhole and other cross-chain incidents (2022–2023 era) forced Solana builders to rework interchain trust assumptions, accelerating robust bridging designs and treasury-level insurance solutions. Those changes reduced single-point failures at a material cost.

Real-world use cases in 2026: where Solana actually wins now

Solana’s sweet spots today are low-latency trading rails, micropayments, gaming back-ends with heavy state updates, and high-frequency NFT drops that need low slippage. Institutional APIs for order execution on Solana matured in 2025, attracting market-making desks that value sub-second confirmation and predictable settlement windows.

Concrete evidence: exchanges and liquidity providers reported using Solana for fast on-chain settlement corridors in 2025. That practical adoption matters more to corporate treasury teams than theoretical TPS.

Comparison table: Solana vs Ethereum (post-rollup era) — speed, cost, security

| Feature | Solana (2026) | Ethereum + Rollups (2026) |

|---|---|---|

| Typical finality latency | ~400ms–1s | ~5–30s on L2 (instant UX via optimistic/finality abstracts) |

| Average production TPS (2025) | ~1,000 TPS (sustained) with spikes to 5k+ | L2 combined throughput varies; single-rollup hundreds to low thousands |

| Typical fee per simple transfer | <$0.01 | ~$0.10 (L2)–$0.001 (optimistic aggregate cases) |

| Recent major downtime incidents | Multiple historical halts; reduced frequency by 2025 | Extremely rare at consensus layer; L2 incidents vary by operator |

| Primary risk | Liveness/leader election, validator economics | Data availability, sequencer centralization in some L2s |

| Sources | Chainspect / Solana Compass / MEXC reports. |

Developer friction: toolchain, languages, and onboarding

Rust-first development and Sealevel runtime give Solana high throughput but raise onboarding friction compared with EVM’s Solidity ecosystem; tooling improved in 2025 with better SDKs, dev tooling, and LSP integrations, lowering time-to-deploy for teams that adopt Rust and SPL patterns.

Fact: many teams still prefer EVM compatibility for network effects, yet Solana’s specialized primitives (parallel runtime, account model) enable unique patterns not easy to replicate on EVM without rollup design tradeoffs.

Market structure: liquidity, AMMs, and order-book projects

On-chain order books (Open Book) and AMMs (Orca, Raydium forks) regained traction after the Serum fallout, but centralized market makers still supply a large share of deep liquidity; hybrid models that combine on-chain matching with off-chain LPs expanded in 2025.

Data: Open Book and Orca saw notable increases in swap and limit activity in the post-FTX era, as builders re-architected market depth with permissioned relayer and visible on-chain settlement.

Governance and decentralization: are validators decentralized enough?

Validator decentralization improved in 2025 via staking distribution initiatives and new validator entrants, but large staked entities and institutional operators still hold meaningful share, leaving governance and slashing policy sensitive to concentrated actors. Solana’s S-1 and fund documents explicitly note reputational risk tied to prominent contributors.

Fact: VanEck documentation and Solana filings acknowledged concentration risk around high-profile contributors and the network’s open-source governance model — a notable transparency step that also signals potential single-entity perception sensitivity.

Risk checklist for traders, builders, and institutions

Key risks: liveness/halts, bridge and custody exploits, validator concentration, and volatile fee/revenue cycles. Mitigations include multi-sig treasury controls, staged rollouts, conservative leverage, and choosing execution venues with Deep Depth order books for big fills.

Practical steps I recommend:

- Use well-audited bridges and multi-sig for treasury.

- Limit leverage when TVL or fee revenue is collapsing.

- Prefer exchanges and LPs with proven uptime and deep order books when executing large blocks. (Example: consider stable venues and check status.solana.com during heavy drops.)

Expert takeaways: three original insights you won’t find in PR blurbs

- Sustained adoption beats peaks: protocols with steady fee streams matter more to long-term valuation. 2) Liveness hardening is a multi-year process that combines protocol fixes with economic design. 3) Cross-chain trust redesigns will define whether Solana’s throughput becomes a global rails advantage or a regionalized niche.

Each insight is grounded in 2025 data: network revenue normalization, repeated liveness patches, and bridge redesigns all point to a maturation phase rather than a simple bubble-or-bust framing.

Where to trade and hedge Solana exposure

If you need execution and hedging during volatile policy cycles, use venues with deep order books and fast settlement corridors. For spot and futures access, test execution on production-grade venues and confirm slippage on block sizes before committing capital. For quick access, register at WEEX for spot and futures rails.

Neutral note: register at WEEX if you want a platform that emphasizes liquidity and predictable fills during news-driven volatility. Use test blocks and filler orders to measure real slippage before large deployments.

Final assessment: growth runway vs repeating bubble

Solana is not a simple repeat of past bubbles; it shows product-market fit for low-latency rails but must keep proving reliability, decentralization, and sustained revenue. If Solana delivers multi-year uptime improvements and diversifies validator economics, speed becomes a durable moat—otherwise, cycles of hype and retrenchment will return.

To be honest: I’m bullish on the utility thesis but cautious on valuation until revenue and governance metrics consistently improve. I’ve seen projects rally on hype and fail when the market re-prices risk. Solana’s 2026 story is now about execution and trust.

You may also like

What Is Copy Trading? Your Complete Guide to Getting Started in Crypto

Copy trading has surged in popularity within the crypto world, especially as platforms like WEEX integrate it seamlessly…

How Does an ETF Work? Your Essential Guide to Exchange-Traded Funds in Crypto and Beyond

Exchange-traded funds, or ETFs, have surged in popularity lately, especially with the 2024 approvals of spot Bitcoin ETFs…

What is BORT Coin (BORT)?

Cryptocurrency enthusiasts have something new to explore on WEEX Exchange: the listing of BORT Coin (BORT) paired with…

BORT USDT Premieres on WEEX: BORT Coin Exclusive Listing

WEEX Exchange is thrilled to announce the world premiere listing of BORT Coin (BORT), an innovative token empowering…

What is Liora Nuclear Beam (BEAM) Coin?

We are thrilled to announce that the BEAM/USDT trading pair is now available on WEEX, with trading commencing…

BEAM USDT Exclusive Debut on WEEX: Liora Nuclear Beam (BEAM) Listing

WEEX Exchange is thrilled to announce the exclusive world premiere listing of Liora Nuclear Beam (BEAM) Coin, powering…

What is Rentahuman (RENT) Coin?

We’re excited to announce the listing of Rentahuman (RENT) on WEEX, a cutting-edge token that is now available…

RENT USDT Debuts on WEEX: rentahuman (RENT) Coin World Premiere

WEEX Exchange proudly announces the world premiere listing of rentahuman (RENT) Coin, with RENT USDT trading now live…

What is Spot DCA? Your Essential Guide to Smarter Crypto Investing in Volatile Markets

As of February 4, 2026, the crypto market continues to show its unpredictable side, with Bitcoin hovering around…

Where Will Bitcoin Go in 2026? Expert Price Predictions and Market Outlook

Bitcoin has kicked off 2026 on a shaky note, with its price dipping to around $77,500 as of…

What Is Liquidation in Crypto? Essential Guide for Traders to Manage Risks and Avoid Losses

As of February 4, 2026, the crypto market continues to grapple with high volatility, with Bitcoin experiencing a…

BORT Coin Price Prediction & Forecasts for February 2026: Could This New AI Agent Token Surge 50% Amid BSC Ecosystem Growth?

BORT Coin has just made waves with its fresh listing on WEEX Exchange, launching BORT/USDT trading on February…

Liora Nuclear Beam (BEAM) Coin Price Prediction & Forecasts for February 2026 – Could It Rally 50% Amid New Listings?

The Liora Nuclear Beam (BEAM) coin has just made waves in the crypto space with its fresh listing…

rentahuman (RENT) Coin Price Prediction & Forecasts for February 2026 – Fresh Listing Sparks Potential Rally

The rentahuman (RENT) coin has just hit the market today, February 4, 2026, with trading kicking off on…

XRP (Ripple) in 2026: Is Cross-Border Payment Finally Taking Off?

Is XRP’s cross-border payment use case finally taking off in 2026? This in-depth analysis examines regulation, institutional adoption, XRPL technology, and real-world settlement data.

Can I Invest in MrBeast Meme Coin? MrBeast Meme Coin Price Prediction 2026

MrBeast Meme Coin ($BEAST) is a community-driven cryptocurrency that emerged from internet culture rather than traditional blockchain development. Despite its name association with YouTube superstar MrBeast (Jimmy Donaldson), this token operates without his official endorsement, partnership, or involvement.

What is Dai (DAI) Coin?

We’re thrilled to announce another exciting addition to our trading platform: the Dai (DAI)/USDT trading pair is now…

DAI USDT Pair Debuts on WEEX with Dai (DAI) Coin Listing

WEEX Exchange is thrilled to announce the listing of Dai (DAI), a leading stablecoin, with DAI USDT trading…

What Is Copy Trading? Your Complete Guide to Getting Started in Crypto

Copy trading has surged in popularity within the crypto world, especially as platforms like WEEX integrate it seamlessly…

How Does an ETF Work? Your Essential Guide to Exchange-Traded Funds in Crypto and Beyond

Exchange-traded funds, or ETFs, have surged in popularity lately, especially with the 2024 approvals of spot Bitcoin ETFs…

What is BORT Coin (BORT)?

Cryptocurrency enthusiasts have something new to explore on WEEX Exchange: the listing of BORT Coin (BORT) paired with…

BORT USDT Premieres on WEEX: BORT Coin Exclusive Listing

WEEX Exchange is thrilled to announce the world premiere listing of BORT Coin (BORT), an innovative token empowering…

What is Liora Nuclear Beam (BEAM) Coin?

We are thrilled to announce that the BEAM/USDT trading pair is now available on WEEX, with trading commencing…

BEAM USDT Exclusive Debut on WEEX: Liora Nuclear Beam (BEAM) Listing

WEEX Exchange is thrilled to announce the exclusive world premiere listing of Liora Nuclear Beam (BEAM) Coin, powering…

Earn

Earn